Decoding Premium Financing and its Risks

What is Premium Financing?

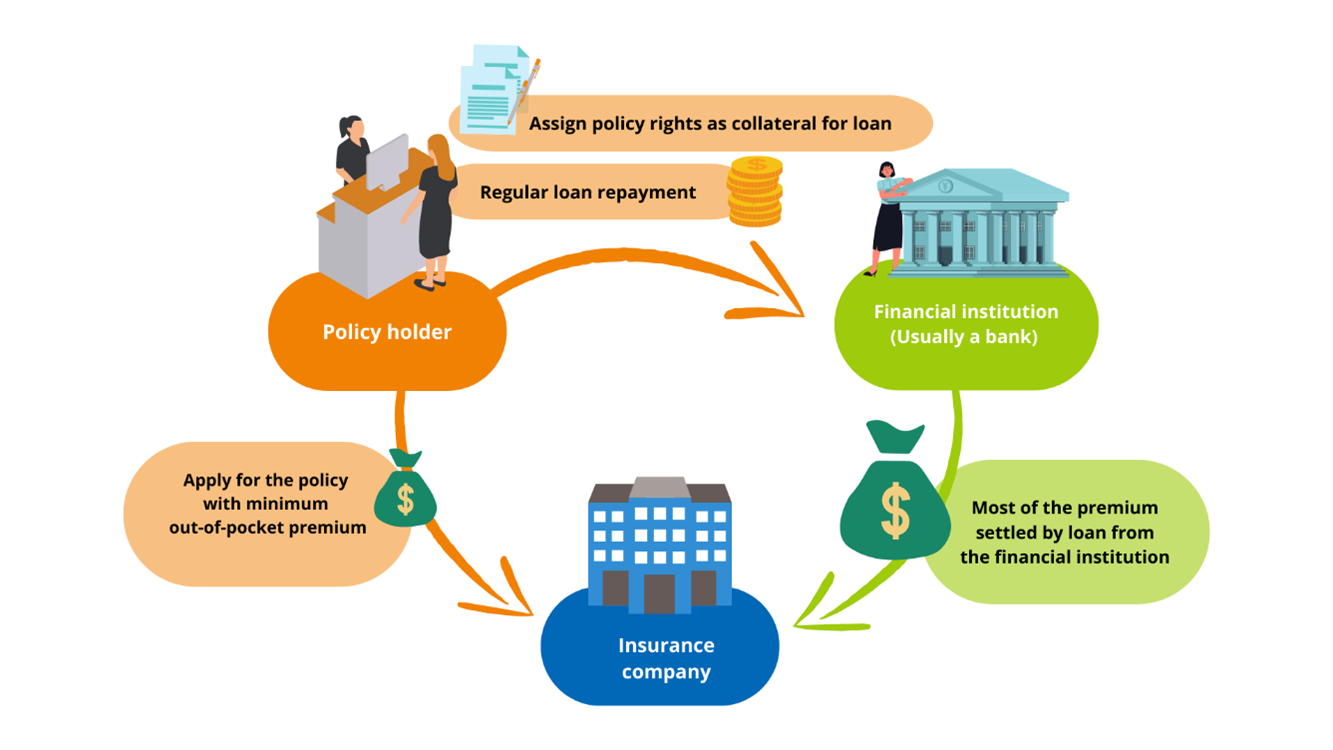

Premium financing is an insurance funding arrangement whereby a policy holder borrows funds from a financial institution (usually a bank) to pay the premium of a new insurance policy, and in doing so, assigns all or part of the rights under the proposed policy as collateral to the financial institution. In general, the policy holder is only required to pay part of the premium out of his/her own pocket and settle the remainder of the premium via a loan from the financial institution, and is, to some extent, similar to buying a property with a mortgage loan. This method of using a loan to finance the purchase is also known as “leveraging”. In a low interest rate environment, the policy holder can borrow funds from a financial institution at a lower cost and invest them in an insurance policy with a higher return to profit from the spread.

Since the policy is pledged to the financial institution, any policy benefits paid by the insurer (e.g. the surrender value and death benefits) have to be first used to settle the outstanding loan amount and interest, with the remaining balance (if any) then goes to the policy holder or the beneficiary.

Premium financing involves the use of the cash value of a policy as collateral for a loan. Therefore, it is more commonly used in purchasing policies with a cash value, such as participating policies, universal life policies and various types of endowment policies. Protection products, such as term life or Voluntary Health Insurance Scheme policies, which typically do not have any cash value, are rarely seen in premium financing arrangements as they are less likely to be accepted as collateral.

Premium financing is also a stand-alone arrangement between the policy holder and the financial institution. It is not part of the insurance contract. Policy holders should consult the financial institution that offers the loan (not the insurer nor the insurance intermediary) for any questions about the terms and conditions of the loan contract.

Why is premium financing becoming more popular?

New office premiums for individual life insurance business involving the use of premium financing have been increasing in recent years, reflecting the growing use of premium financing by policy holders as a tool for wealth and liquidity management.

The following reasons contribute to its growing popularity:

- Low interest rate environment: Given the prolonged period of low interest rates in the past years, policy holders can borrow funds from financial institutions at a lower cost which provides an edge in leveraged borrowing and interest rate arbitrage.

- Attractive to lenders: Policies with cash value guaranteed by insurers are used as loan collateral for premium financing. From the financial institution’s perspective, the lending is more secure as the financial institution can still withdraw the cash value from the policy to settle any outstanding debt if the policy holder is unable to meet the loan repayments.

Useful Information

Before using premium financing to purchase life insurance policies, policy holders should consult their insurance intermediary regarding its nature and the possible implications and risks involved. They should also consult their financial institution about the terms and conditions related to their loan contract. Policy holders may also refer to the following information: