Insurance veterans explore risks and opportunities arising from global climate change

19 January 2021

Climate change has been cited as a major threat to the global economy and the financial system as extreme natural hazards have become more common and caused significant economic losses across different sectors over the last decade. The Insurance Authority (IA) hosted a thematic breakout session, titled “Climate Change Risks and Opportunities for Insurance”, today (19 January 2021) at the Asian Financial Forum (AFF)1 to examine how the insurance industry should respond to this global issue, and capture the opportunities out of it toward a sustainable economy.

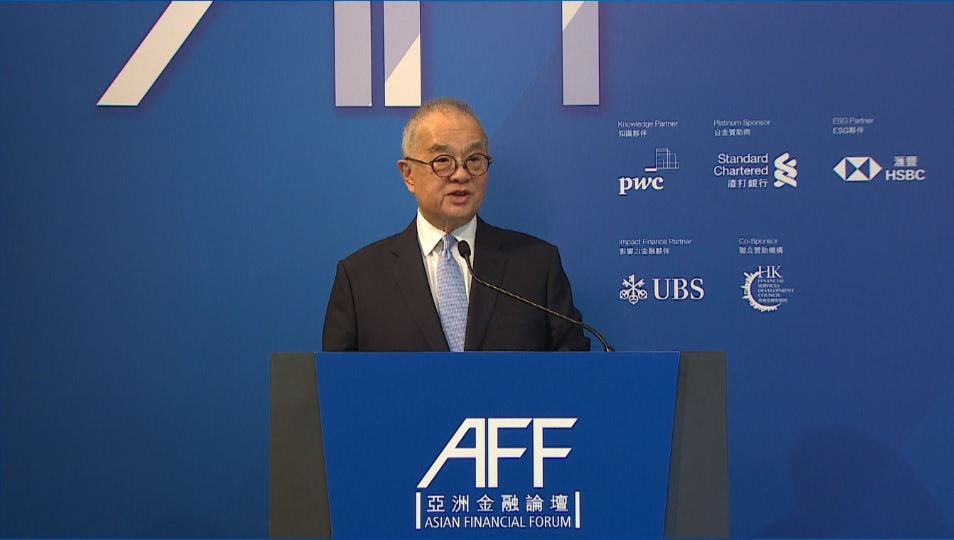

“Rising temperatures bring higher sea levels and affect ecosystems. What used to be called rarities such as super typhoons, severe blizzards, sprawling bushfires, parching droughts and drenching precipitation have become regular occurrences,” said Dr Moses Cheng, Chairman of the IA, in the opening speech. “Apart from diligently fulfilling the duty to act as good corporate citizens, the insurance industry does have a multiple role to play as risk assessors, risk advisers, risk underwriters and institutional investors. Climate change presents huge prospects for those who are able to facilitate adaptation and mitigation.”

The panel, comprising seasoned senior executives from insurance and reinsurance companies, talked about the industry’s awareness of the impact of climate change risks to their business, and shared experience on how the environmental impact should be factored in when underwriting complex projects. The latest trend of insurance product development in supporting a greener and more sustainable economy, and the opportunities to be unfolded by both the life and non-life insurance sectors were also deliberated.

The panelists also considered that insurers and reinsurers could, as investors of green bonds and issuers of insurance-linked securities, contribute to mitigating climate risks and creating an ecosystem for green and sustainable finance in Hong Kong.

Ends

Note:

1Asia's premier platform for global leaders in government, finance and business to exchange insights, intelligence as well as business and investment opportunities. More than 3,500 C-suite financial and business leaders gathered at AFF 2020 for thought leadership and business networking, as well as to experience the latest fintech innovations and next-generation business ideas.

Dr Moses Cheng, Chairman of the IA, delivers the opening remarks in the panel session.

The panel, comprising seasoned senior executives from insurance and reinsurance companies, discusses how the insurance industry should respond to climate change and capture the related opportunities.