Understanding a Participating Policy

The sales process in general

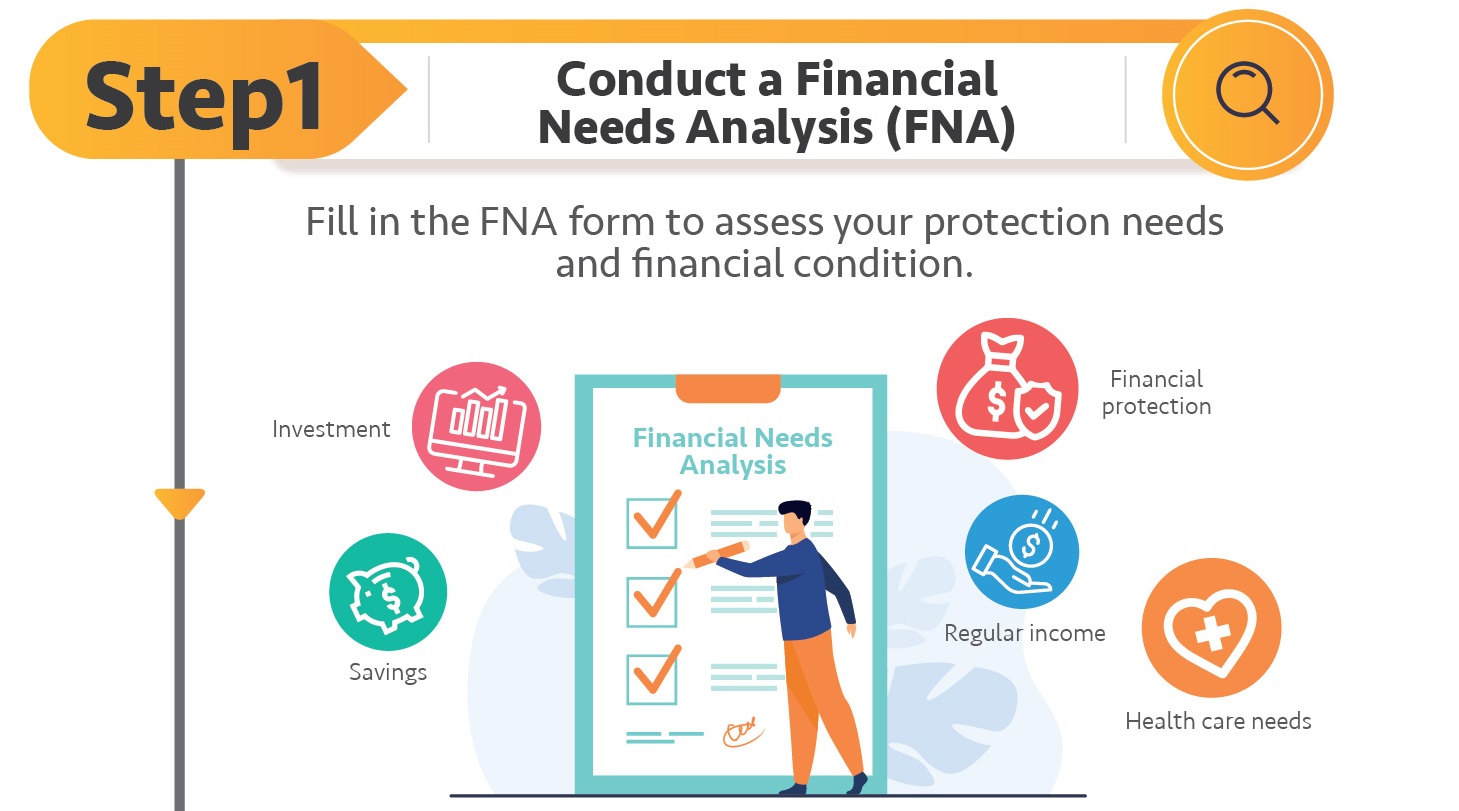

The insurer or insurance intermediary will ask you to fill in the FNA form, which normally covers questions about your objectives for buying an insurance product, your source(s) of income, your expected coverage and premium payment period, etc. Through this analysis, you can assess your protection needs in the following areas:

- Financial protection

- Health care needs

- Regular income

- Savings

- Investment

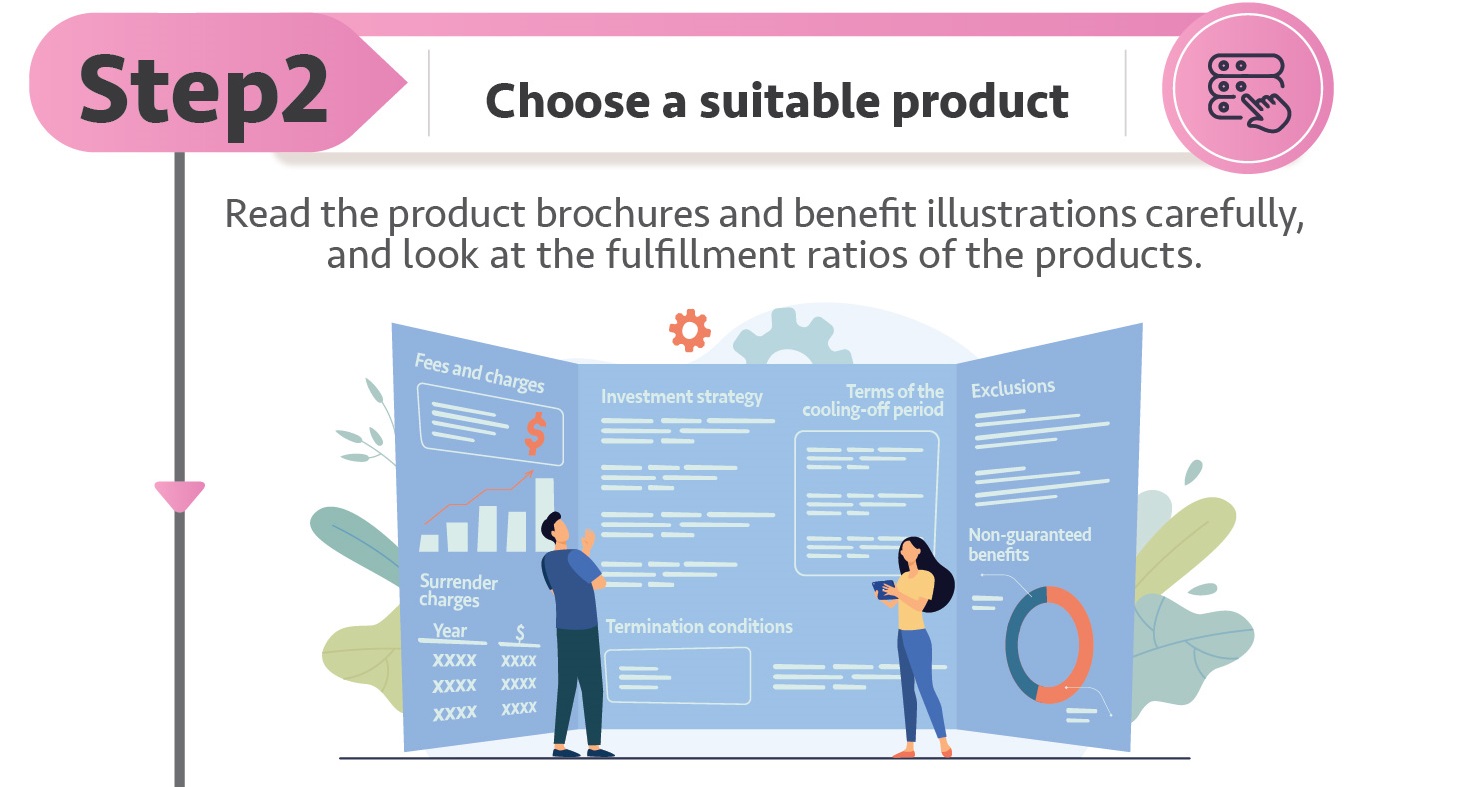

The insurer or insurance intermediary will recommend a suitable product to you based on the FNA results and provide you with information of the respective product, including product brochures, benefit illustrations and a website link showing the fulfillment ratio. Read the information carefully to make sure you understand the product features and the insurer’s philosophy for bonus and dividend distribution, including:

- Investment strategy (e.g. target asset mix)

- Fees and charges, if applicable

- Surrender charges, if applicable

- Exclusions

- Termination conditions

- Terms of the cooling-off period

- Proportion of non-guaranteed benefits and potential volatility

You have to complete the application form and answer all the underwriting questions, such as your age, occupation and health condition. Disclose all your information to the insurer actively and honestly, so that the insurer can reasonably assess the risk based on the disclosed information. The insurer will then consider if you have to submit supplementary information or undergo a medical examination and decide whether to accept your application and how to design the policy terms.

You have to pay the premium according to the policy terms after submitting your application. It can generally be paid in a single premium or by instalments (i.e. annually, monthly, quarterly or half-yearly). Be reminded to use the official methods specified by the insurer to pay the premium directly to the insurer rather than pay it via your insurance intermediary.

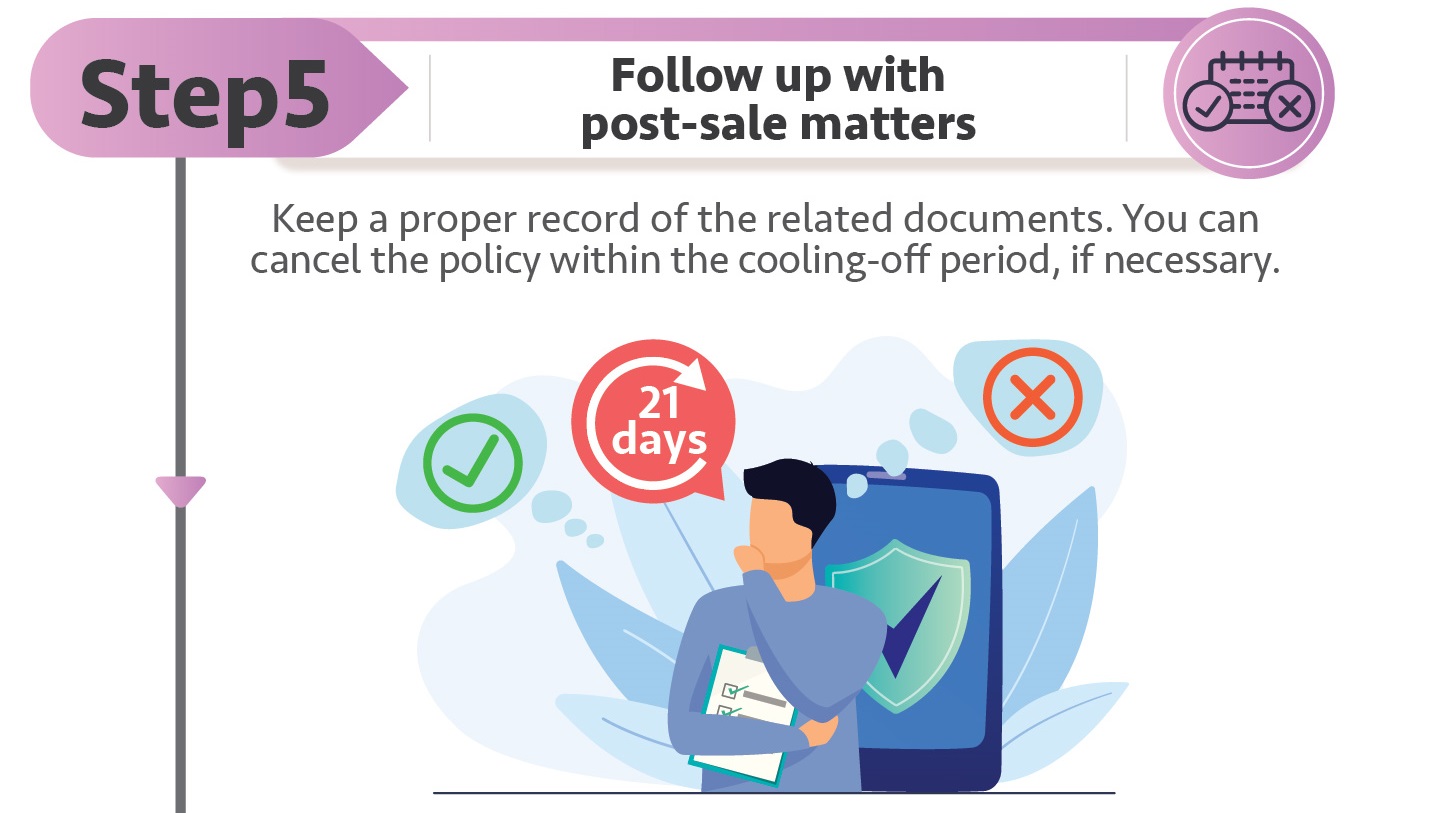

Under the cooling-off period mechanism, you have the right to review the terms and conditions of the policy after your purchase. If you find that the policy you have purchased is not suitable for you, you can cancel the policy within the cooling-off period*. The insurer must offer a full refund of the insurance premium you paid or an amount less a "market value adjustment", if applicable. If you have no intention of cancelling your policy, keep a proper record of the related documents, including the policy terms and conditions, benefit illustrations, and premium payment receipt. If you have any questions, consult your insurer or insurance intermediary as soon as possible to protect your interests.

* The cooling-off period is 21 calendar days immediately following the day of delivery of the Policy or the Cooling-off Notice to the policyholder or the policyholder's nominated representative (whichever is earlier).

Under the existing regulatory framework, the above procedures may be conducted via non-face-to-face sales. Some insurers have launched a virtual onboarding service in a pilot run to allow insurance intermediaries to conduct FNA and complete the entire application process with policyholders via video conferences. For details, refer to the Insurance Digital Onboarding page on this website.