Mystery Shopping on Roadshow Activities

September 2025

This publication is called “Conduct in Focus” because a core function of the IA is to regulate, supervise and promote proper standards of conduct in the insurance market. “Conduct”, in this context, refers to the ways in which insurers and licensed insurance intermediaries conduct themselves, when dealing with members of the public on insurance matters.

Regulating conduct standards requires the IA to view matters through the eyes of a customer of insurance. Protecting their interests is why we - the IA - exist. Sometimes there is no better way to do this, than to become a customer ourselves, and obtain firsthand experience of the conduct of the insurance intermediary and insurer with whom we have dealings in that role.

This, in essence, is what mystery shopping enables the IA to do and it is a tool which we regularly use as part of our ongoing supervisory activities.

During Golden Week in May, for example, when Canton Road was bustling with shoppers and eager insurance intermediaries trying to catch their attention, among the crowds you would have found IA employees (as mystery shoppers) being approached as potential insurance customers.

In addition, the Enforcement Division recently conducted a 3-month mystery shopper exercise on insurance-related roadshow activities which are a common sight in the streets, exhibition halls and shopping malls of Hong Kong. In this exercise, employees of the IA – as potential insurance customers – were engaged by around 25 licensed individual insurance intermediaries, appointed by 8 different principals, including insurers and insurance broker companies. Our observations are presented below:

Overall observations

Positives

All the roadshows were marked with the relevant principal’s brand or logo making it clear to the public, which principal the licensed intermediaries represented. The salespeople with whom our staff engaged, were all licensed individual insurance intermediaries. All of them presented their business cards which clearly displayed their IA licence number and details of their appointing principal. They presented relevant insurance products in a professional manner and took time to explain, amongst other matters, the purpose of the financial needs analysis for life insurance products, the importance of declaring any prior medical conditions when applying for a medical insurance policy, the difference between guaranteed and non-guaranteed returns and the available tax deductions for VHIS and QDAP policies.

Areas that need improving

Certain promotional materials displayed or distributed at the roadshows were self-made, (that is, made by the individual insurance intermediaries themselves rather than by their principals, who had also not approved their use). Some were so obviously self-made, as to prompt the customer to question their purpose and provenance. The explanation given was that the formal promotional materials (as provided by the principal) were too complex for illustration purposes!

One licensed individual insurance intermediary used a self-made excel spreadsheet that generated an illustration of the premium amount and return of a particular insurance product based on the age of the customer. The spreadsheet did not, however, indicate which projected returns were guaranteed and non-guaranteed. The intermediary was only forthcoming about this, when asked.

Here is why mystery shopping is so valuable. It gives the IA certain insights that a customer would have on a licensed insurance intermediary’s conduct, that the insurance intermediary may not even see in him or herself.

For example, an insurance intermediary that tells a potential customer that his/her self-made materials serve to simplify matters for the customer (when compared to the formal ‘complex’ materials provided by the principal), may think this creates an impression of being helpful to the customer. However, from the customer’s perspective the actual underlying messages being conveyed by this, are: (i) the customer is not intelligent enough to understand the formal approved materials; and (ii) the insurance intermediary does not trust the information provided by his or her principal. Neither of these underlying messages would serve to build the kind of trust on which the insurance market depends.

Similarly, the insurance intermediary with the self-created spreadsheet, may believe that he or she is giving confidence to the customer by displaying such knowledge and skills. But if crucial information is being omitted (and the fact that certain benefits illustrated in the spreadsheet are non-guaranteed, is absolutely crucial), then this conveys an impression of a lack of knowledge on the part of the intermediary, and raises questions with the customer about the intermediary’s integrity.

One of the underlying lessons to emerge from this exercise is that, when it comes to roadshows, first impressions count. Principals and intermediaries should focus on how their conduct is perceived by the potential customers with whom they have dealings. There is no better way to create the right first impression, than by being professional and ethical in substance from the outset and in everything you do. This will get you much further in building trust, than trying to create an image of being clever with fancy spreadsheets and colourful self-made materials.

Reinforcement of true professional and ethical conduct through principals establishing effective governance and compliance mechanisms to monitor the roadshow activities, is equally important and we provide some general tips on this below.

Effective corporate governance on roadshow activities by Principals

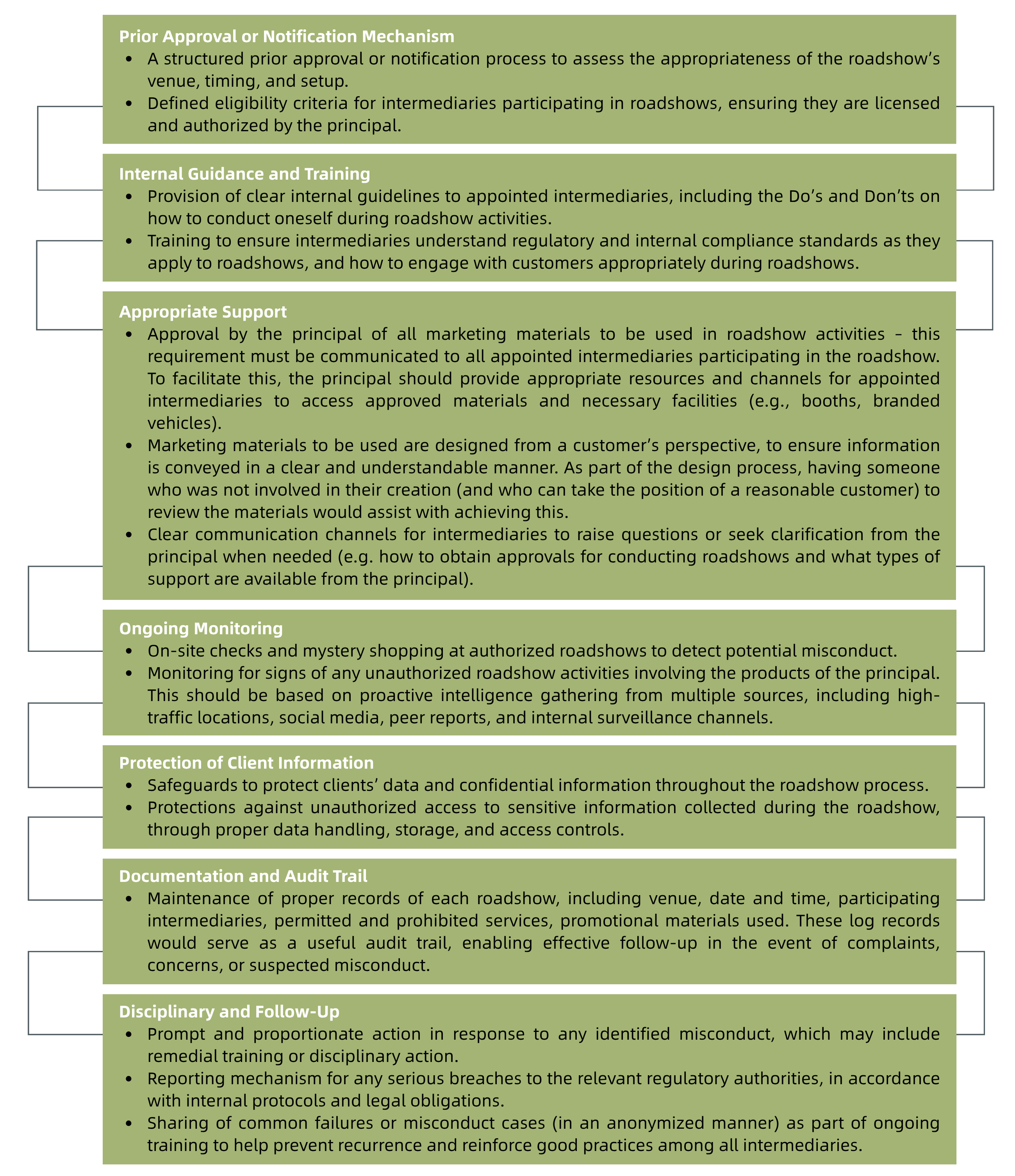

An effective control and governance framework put in place by principals for roadshow activities might include the following elements:

Licensed intermediaries’ conduct behavior – Do’s and Don’ts

We also provide the following key Do’s and Don’ts to assist licensed individual insurance intermediaries who participate in roadshow exercises, to understand their conduct obligations:

By keeping these points in mind, licensed intermediaries can help ensure that their participation in roadshows aligns with regulatory expectations and upholds the reputation of both themselves and their principal. Conduct that is ethical, transparent, and customer-focused is essential to building lasting trust with the public. Remember, the next customer you meet, could be from the IA!

Notes:

1 Code of Conduct for Licensed Insurance Agents and Code of Conduct for Licensed Insurance Brokers