Complaint Statistics

September 2025

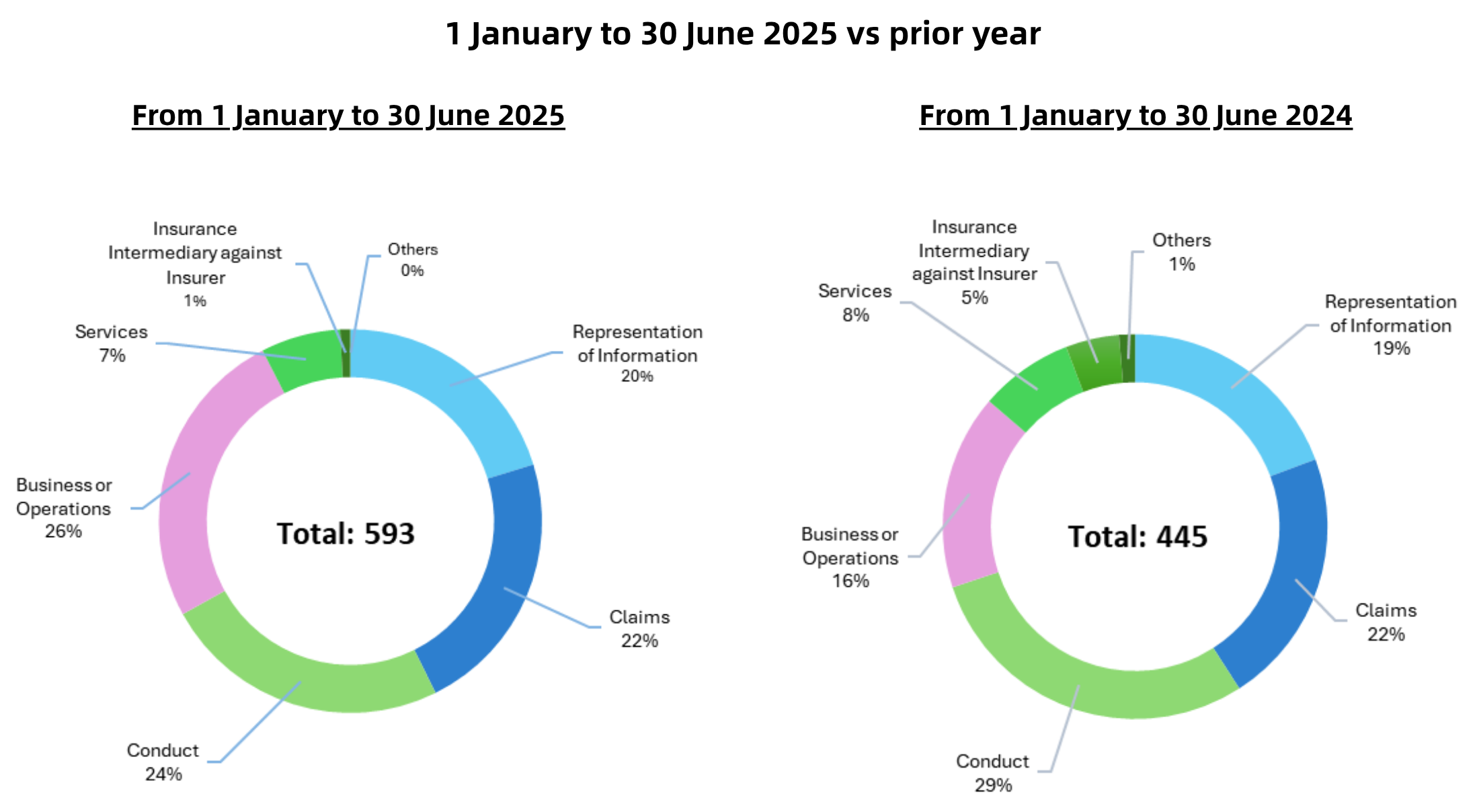

In this edition we present the complaints statistics for the first half year of 2025.

Explanation of Complaint Categories

Conduct – refers to complaints arising from the process in which insurance is sold, the handling of client’s premiums or monies, cross-border selling, unlicensed selling, allegations of fraud, allegations of forgery of insurance related documents, commission rebates and “twisting” (i.e. insurance agents inducing their clients to replace their existing policies with those issued by another insurer by misrepresentation, fraudulent or unethical means).

Representation of Information – refers to complaints relating to the presentation of an insurance product’s features, policy terms and conditions, premium payment terms or returns on investment, dividend or bonus shown on benefit illustrations, etc.

Claims – refers to complaints in relation to insurance claims. The IA cannot adjudicate insurance claims or order payment of compensation. It can, however, handle complaints related to the process by which claims are handled (e.g. delays in processing, lack of controls or weaknesses in governance, areas of inefficiency in the claims handling process).

Business or Operations – refers to complaints related to business or operations of an insurer or insurance intermediary, (for example, cancellation or renewal of policy, adjustment of premium, underwriting decision, or matters related to the management of the insurer, etc.).

Services – refers to complaints regarding insurance related servicing by insurers or intermediaries, such as complaints related to the delivery of premium notice or annual statement, dissatisfaction with services standards etc.

The statistics show a 33% increase in complaints to the IA during the first six months of 2025 (593 complaints), as compared with the same six months in 2024 (445 complaints) – an increase of 148 complaints in total.

In part, the increase was due to a rise “Business or Operations” complaints, a category which covers complaints about the operational procedures of insurers and intermediaries in effecting actions to insurance policies such as cancellations, surrenders, renewals and other administrative matters. Whilst no single root cause can be identified for these types of issues, a number of differing trends can be spotted in the statistics depending on type of action.

- For surrenders of long term insurance, by way of example, the steps that need to be taken to process a surrender request in the early years of a policy are necessarily more burdensome. This, can lead to consumer dissatisfaction in having to provide the information requested. These steps, however, serve as essential policyholder protection measures. They ensure policyholders understand the potential downside implications of the decision they are making and allow time for reflection. Insurers also need to manage the anti-money laundering risk that comes with early surrenders. The lesson here is that better communication on the reasons for requesting such information (as opposed to just making the requests) is needed. If this is coupled with high efficiency in processing the information once received and actioning the surrender, the level of grievance would be replaced by better understanding.

- Also, some complaints related to cancellation and renewal are about policies being cancelled by insurers, lapsation of policies and problems when handling the revival of lapsed policies. While the reasons for these complaints may vary, the overall increase generally suggests that policyholders are becoming more aware of the steps and requirements involved in these processes, as they now pay closer attention to their own policies rather than relying solely on intermediaries to handle everything.

Another drive of the increase can be put down to a correlation with the rise in Mainland China Visitors (“MCV”) to Hong Kong over the same period. MCV policyholders, when they visit Hong Kong, often take the opportunity to raise questions (at an insurer’s customer service centre) concerning insurance policies they purchased on previous visits. Typically, these complaints concern long term insurance policies and are indicative of the time-lag between a policy being sold, and issues emerging with the performance of the policy as the years elapse and annual statements are delivered. A number of these complaints concern policies sold in the years prior to the pandemic, at a time when MCV business was at its peak. The ongoing work by the IA in 2024 to 2025 to ensure standards of advice are upheld at the point of sale, and that insurance intermediary remuneration incentivizes ongoing servicing of policies as well as sales, aims to address the root cause of many of these issues.

It is also important to put these statistics in a wider context. Whilst the number of complaints in the first six months of this year shows a rise as compared to the same period last year, a longer term perspective shows a different trend. The 593 complaints received by the IA in first six months of 2025 is down 24% from the 778 complaints received in the first half of 2020 (a time of pre-pandemic levels of activity, to which the insurance market is now returning) and is indicative of a longer term structural trend towards improvement.

In conclusion, the trends behind the snapshot comparison between the first six months of 2025 versus the same period in 2024, show different reasons for the one-year time-period increase, albeit this should be assessed in the context of a continued lower number of complaints when a wider 5 year time-period is taken. With that said, the increase over the one-year period, should serve as an important reminder of the need for continued vigilance. It is imperative that all insurers and insurance intermediaries continually re-commit to maintain professional conduct standards when dealing with consumers on all aspects of their insurance needs, whether at the point of sale or through continued servicing. This is how trust in the insurance market is constantly reinvigorated.

Information on the IA’s complaints handling process

Generally, the IA only receives complaints after the complainant has exhausted the complaints procedures of the relevant insurer or intermediary. This is only right. Since it is the insurer or intermediary being complained about, they should have the first opportunity to address the grievance and maintain the relationship with the customer.

As part of its conduct supervision, the IA assesses the complaints handling procedures of insurers and intermediaries to ensure that they are founded on the “treating customers fairly” principle. Complaints can never be eliminated altogether – they are a fact of business-life. How they are handled by an insurer/intermediary and how the complainant is treated in that process, speaks volumes about these attitudes and culture within an insurer or intermediary company and the degree of its customer-centricity. As part of its conduct supervision, the IA holds insurers and intermediaries to account for the fairness of their complaints handling procedures.

As a handler of complaints ourselves, we (the IA) also hold ourselves to high standards of fairness, efficiency and transparency.

- Since 1 September 2023, we have committed to concluding 80% of the complaints within six months from the date they are received1. For those complaints received in 2024, we successfully concluded 88% of them within this timeframe.

- Want to know how we assess complaints and what actions we may take if a complaint is substantiated? This is explained in our leaflet “What Happens After You Submit a Complaint?” which can be found on our website [LINK].

Notes:

1 This period begins from the date on which written consent and supporting documents are received from the complainant to the date on which referral was made to the IA Enforcement Division or Supervision Teams for follow-up action, or the date on which a letter of conclusion is issued. Cases referred to related parties (such as other regulators, the Voluntary Health Insurance Scheme Office, or Insurance Complaints Bureau) for handling are excluded.